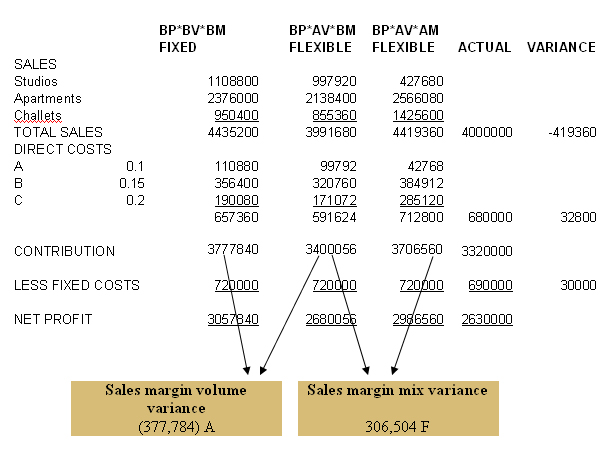

a) Prepare a statement showing the fixed budget, flexible budgets, actual results and variances for the quarter

This question has sales mix complications and thus a sales mix variance will have to be separately calculated. This is done by preparing a second flexible budget and comparing at contribution level the difference between the first flexible and second flexible budgets. The following approach is recommended

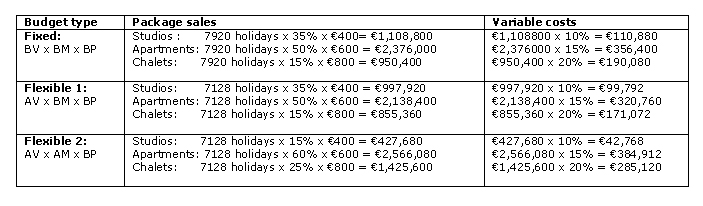

Step 1: Prepare the fixed budget. All the figures in the fixed budget are based on the original budget assumptions about sales price, sales volume and sales mix.

Budgeted price x budgeted volume x budgeted mix (BP x BV x BM)

Step 2: Prepare the flexible budget (flexible budget 1). This budget is based on actual volume sales, but at the original budgeted mix and budgeted prices. Any difference in contribution between the fixed and the flexible budget is due to the volume variance and hence this variance is isolated.

Budgeted price x actual volume x budgeted mix (BP x AV x BM)

Step 3: Prepare a second flexible budget (flexible budget 2). This budget is based on actual volume and the actual sales mix but at budgeted price. The difference in contribution between the first and second flexible budgets is due to the sales mix variance and hence this variance is isolated.

Budgeted price x actual volume x actual mix (BP x AV x AM)

Step 4: Enter the actual figures.

Actual price x actual volume x actual mix (AP x AV x AM)

Step 5: Find the price or cost variance. This is the difference between flexible budget 2 and actual figures.

In calculating the budgeted sales volume figure we are told in the question that the company a rental capacity of 13,200 accommodation weeks. If the fixed budget is based on 60% of capacity then the budgeted volume sales = 60% x 13200 = 7,920.

The calculation of the sales and variable costs figures are as follows:

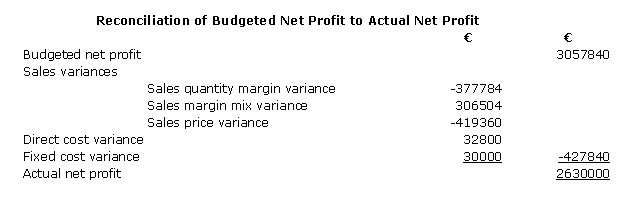

b) Prepare a statement reconciling the budgeted net profit to the actual net profit

c) Write a short report to the general manager of the Sunshine Resorts Ltd evaluating the results you have produced and suggesting possible reasons for the variances

Overall management will be unhappy with not achieving the overall target profit. Actual profit is 14% (427840/3057840) less than budgeted. The following are the main variances calculated

Sales quantity margin variance: The actual sales activity level fell by 10%. This ensured that actual net profit was 14% less than budgeted. Management should assess the reasons for the variance including assessing the quality of the budget target (was the budgeted figure of 60% of capacity overly optimistic), the level of competition and other factor such as pricing, and the state of the local and global economies. The sensitivity rating for sales volume is 1.4 times (14/10) telling us that for every 1% fall in sales volume profit falls by 1.4%.

Sales margin mix variance: This is a negative variance of €306,540 and is caused by differences between budgeted and actual sales mix. The effect of this variance is that profit fell 10% due to these changes. The main differences between budgeted and actual sales mix was the fall in demand for the high profit studios. Studios achieve a contribution margin of 90% In contrast the chalets which achieve a contribution margin of 80% increased in demand

Sales price variance: This was a negative variance of €419,360. This was the highest variance with actual average sales price 9.5% lower than budget. Management must assess the reasons for this especially in line with the fall in demand. Was the budgeted figure reasonable and achievable. The effect of this variance is that actual profit is 13.7% lower than budget. This gives a sensitivity rating of 1.48. Management need to focus on the factors that influence price such as level of competition, socio economic factors etc.

Direct cost variance: This is a favourable variance of €32,800. Actual direct costs were 4.6% less than budget and this ensured that actual profit was 10.7% higher than budget. Management must question the budget figure and find the cause of the savings. The direct costs for accommodation rent are generally cleaning and maintenance.

Fixed costs: Fixed costs decreased by €30,000 or 4.2%. To further analysis this variance management need to break down fixed costs into its component parts and analyse significant movement s in the various expenses. Again in their analysis management must question the budget figure and its reasonableness.