Solution 4.10

a)Calculate, based on variable cost levels of 35 per cent, 40 per cent and 45 per cent, the annual break-even point for the heritage centre, t he number of customers required to give the heritage centre a return on investment of 20 per cent and the margin of safety at this level of profit.

Fixed costs are €135,000

Profit for a return on investment of 20% = €62,000 (€310,000 x 20%)

|

Variable costs |

Variable costs |

Variable costs |

|

35% |

40% |

45% |

Sales price(9/1.125) |

8.00 |

8.00 |

8.00 |

Variable Costs |

2.80 |

3.20 |

3.60 |

Contribution |

5.20 |

4.80 |

4.40 |

|

|||

i) Break-even point |

135,000 / 5.2 = |

135,000 / 4.8 = |

135,000 / 4.4 |

|

25961.54 customers |

28125 customers |

30681.82 customers |

|

|||

ii) RoI (20%x310,000) |

135,000+62,000/5.2 |

135,000+62,000/4.8 |

135,000+62,000/4.4 |

|

37,885 customers |

41,042 customers |

44,773 customers |

|

|||

Margin of safety |

11923.08 customers |

12916.67 customers |

14090.91 customers |

|

31.47% |

31.47 |

31.47% |

Note: The margin of safety is calculated by subtracting the break-even point calculated in (1) from the number of customers required to achieve the return. This it is assumed is the forecast sales. The margin of safety can also be calculated as a percentage. For example under variable costs at 35% the % margin of safety is calculated as 11,923/ 37885 x 100

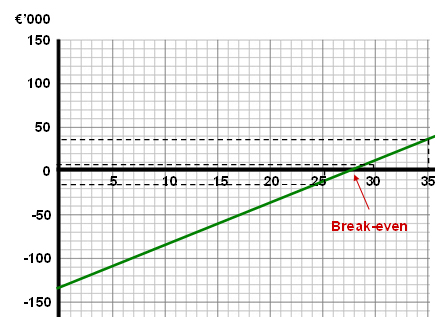

b) Based on variable cost levels of 40 per cent, prepare a profit volume chart estimating profit at demand levels of 25,000, 30,000 and 35,000 customersThe profit or loss based on demand levels of 25,000, 30,000, and 35,000 customers is calculated below and presented in a profit volume chart

|

Profit at demand levels of 25,000 |

|

30,000 |

|

35,000 |

|||

|

|

|

|

|

|

|||

|

Contribution |

€4.8 x 25,000 |

120000 |

€4.8 x 30,000 |

144000 |

€4.8 x 35,000 |

168000 |

|

|

Less Fixed costs |

135000 |

|

135000 |

|

135000 |

||

|

Profits |

-15000 |

|

9000 |

|

33000 |

||

c) If the initial study forecasts a demand of between 25,000 and 35,000 customers, comment on the viability of the venture.

Based on the forecast figure the project is not feasibly if variable costs are greater than 40%. If variable costs are for example 35% then the project is a viable one however it is still unlikely to achieve the required returns of the investors.