a) Calculate the break-even point per return flight and the overall break-even point per annum, assuming flights run 360 days per year

As with most questions in CVP analysis the relevant information must be extrapolated from the question. The information required is as follows

- Fixed costs per return flight

- Variable costs per return flight

- Contribution per return flight

|

Selling Price/person per return flight |

120 |

||

|

Variable costs/person per return flight |

20 |

||

|

Contribution |

100 |

||

|

Fixed Costs per return flight |

|

||

|

Staff cost per flight |

1,000 |

|

|

|

Airport charges per return flight |

500 |

|

|

|

aircraft insurance per annum |

(1152000/4 x 360) |

800 |

|

|

Fuel cost per return flight |

4,500 |

|

|

|

Administration cost for the year |

100,000/4 x 360 |

70 |

|

_____ |

|

||

|

6,870 |

|

||

|

|

|||

|

BEP per flight |

6870 / 100 |

68.695 |

passengers |

|

|

|||

|

BEP per annum |

(68.695 x 4 x 360) |

98920.8 |

passengers |

b) Calculate the annual profit given a load factor of 75 per cent

This requires the calculation of annual sales, annual variable costs and annual fixed costs. Annual sales is calculated as 90 persons (120 x 75% loan factor) x €120 x 4 return flights x 360 days.

|

Sales |

(€120 x 120 x.75 x 4 x 360) |

15,552,000 |

|

|

Less variable costs |

(€20 x 120 x .75 x 4 x 360) |

2,592,000 |

|

|

12,960,000 |

|||

|

Less Fixed costs |

(6869.5 x 4 x 360) |

9,892,080 |

|

|

Net profit |

3,067,920 |

||

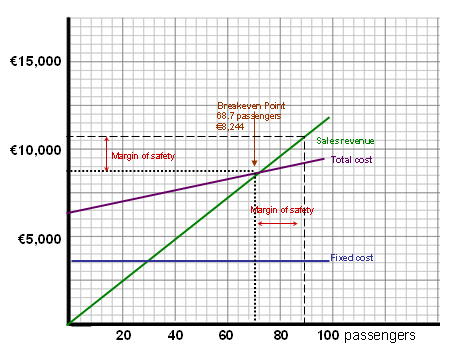

c) Prepare a break-even chart showing the break-even point and margin of safety based on a load factor of 75 per cent

The margin of safety based on a loan factor of 75% is 21 people. This is calculated as simply forecast sales of 90 persons less break-even point sales 69 persons per return flight

d) Calculate the number of customers per flight required to achieve a profit of €4,000,000 per annum

Fixed costs + Profit required 6870 + (4,000,000 /4 x 360) = 96 persons

Contribution per person 100